Can I Earn ₹500 daily from stock market?

Discover the secrets to earning a daily income of ₹500 from the stock market with our comprehensive guide on profitable investment strategies and techniques for beginners on our blog

Content Summary

Table of Contents

ToggleDay trading strategies for earning daily income

Day trading strategies for earning daily income in the stock market typically involve buying and selling stocks within the same trading day.

Some popular day trading strategies include:

- Scalping: Involves making multiple trades throughout the day, with the goal of earning small profits on each trade.

- Momentum trading: Involves identifying stocks that have strong upward or downward momentum and buying or selling accordingly.

- News-based trading: Involves making trades based on news or events that are expected to affect the price of a stock.

- Trend following: Involves identifying and following a stock’s trend, either upward or downward, and making trades accordingly.

- Mean reversion: Involves identifying stocks that are trading above or below their historical average price and making trades accordingly.

It’s important to note that day trading is a high-risk strategy and requires discipline, patience and capital. It’s also important to have a good understanding of the markets and individual stocks before getting started.

Additionally, it’s also important to keep in mind that past performance is not indicative of future results, and investing in the stock market always carries a level of risk.

Investing in dividend paying stocks

Investing in dividend-paying stocks is a strategy that can potentially provide a consistent income stream from the stock market.

Dividends are payments made by a company to its shareholders, usually on a quarterly or annual basis.

When investing in dividend-paying stocks, it’s important to consider the following:

- Dividend yield: This is the annual dividend payment divided by the stock’s price. A higher yield generally indicates a higher income potential, but it’s important to also consider the company’s financial health and stability.

- Dividend growth: A company with a history of increasing its dividends over time may be a more attractive investment, as it indicates a stable and growing business.

- Dividend payout ratio: This is the proportion of a company’s earnings that are paid out as dividends. A lower payout ratio may indicate that the company has more room to increase its dividends in the future.

- Company’s financial health: It’s important to consider the company’s overall financial health and stability before investing in dividend-paying stocks. A company with a strong balance sheet and consistent earnings is more likely to continue paying dividends in the future.

- Diversification: To minimize risk, it’s important to diversify your portfolio by investing in a variety of dividend-paying stocks across different sectors and industries.

It’s also important to keep in mind that past performance is not indicative of future results, and investing in the stock market always carries a level of risk.

Additionally, dividends are not guaranteed and can be reduced or eliminated at any time.

Short selling and earning from stock market declines

Short selling is a strategy that allows investors to profit from a decline in the price of a stock. It involves borrowing shares of a stock from another investor and selling them, with the expectation that the price will fall. The investor can then buy the shares back at a lower price, return them to the lender, and keep the difference as profit.

:max_bytes(150000):strip_icc()/ShortTermTrading_Illustrationv1-f54e9eaf6e284755b59acdec59436265.png)

However, short selling is a high-risk strategy and it is important to understand the risks before getting started. Some of the risks associated with short selling include:

- Unlimited Loss: Short selling is a leveraged strategy, meaning that the potential losses are theoretically unlimited. If the stock price goes up instead of down, the losses can be large and potentially devastating.

- Short Squeeze: A short squeeze occurs when a stock’s price rises sharply, forcing short sellers to buy shares to close their position and limiting their losses. This can push the stock price even higher and increase the losses for short sellers.

- Short Interest: Short interest is the number of shares sold short as a percentage of the total shares outstanding. A high short interest in a stock can indicate that many investors are betting on a decline in the stock’s price. This can also increase the risk for short sellers if the stock price goes up instead of down.

- Risk of Dividends: Short sellers are not entitled to receive dividends from the borrowed shares. Additionally, dividends can increase the stock price, which can further increase the losses for short sellers.

- Short selling is also heavily regulated, and some stocks may not be available for short selling or may have restrictions on short selling.

It’s also important to keep in mind that past performance is not indicative of future results, and investing in the stock market always carries a level of risk.

Additionally, short selling is highly speculative and is not suitable for all investors. Before getting started, it’s important to understand the risks and have a solid plan in place to manage them.

Utilizing options trading for daily income

Options trading is a strategy that can potentially provide a consistent income stream from the stock market, by selling option contracts.

An option contract gives the holder the right, but not the obligation, to buy or sell a specific underlying asset, such as a stock, at a specific price (strike price) on or before a specific date (expiration date).

One way to utilize options trading for daily income is by selling options contracts, also known as writing options.

When selling options, the seller (also known as the option writer) receives a premium from the buyer in exchange for taking on the obligation to sell or buy the underlying asset at the strike price if the buyer chooses to exercise their option.

Some popular options trading strategies for income include:

- Covered Call: This strategy involves selling call options on a stock that you already own. By selling the call option, you can earn a premium while also potentially limiting your potential gains on the stock.

- Cash-Secured Put: This strategy involves selling put options on a stock that you are willing to buy at a certain price. If the stock price falls below the strike price, the buyer of the put option will exercise it, and you will be obligated to buy the stock at the strike price. This strategy can generate income while also potentially providing a lower cost basis for the stock.

- Collar: This strategy involves buying a stock and simultaneously selling a call option and buying a put option with the same expiration date. This can generate income from the premium received from selling the call option, while also providing downside protection from the put option.

It’s important to note that options trading is a high-risk strategy and requires discipline, patience and capital. It’s also important to have a good understanding of options trading, the markets, and individual stocks before getting started.

Additionally, it’s also important to keep in mind that past performance is not indicative of future results, and investing in the stock market always carries a level of risk.

Additionally, options trading is complex and carries additional risks, such as the risk of assignment or exercise. It’s also important to understand the tax implications of options trading.

Identifying and investing in high growth stocks

Identifying and investing in high-growth stocks can be a strategy for earning consistent returns from the stock market. High-growth stocks are companies that are expected to grow their revenues and earnings at a faster rate than the overall market. These companies often have strong fundamentals, such as high sales and earnings growth, and a large addressable market.

Some ways to identify high-growth stocks include:

- Researching the company: This includes analyzing the company’s financials, such as revenue and earnings growth, as well as its industry and competitive landscape. Look for companies that have a strong business model and a large addressable market.

- Analyzing analyst reports: Analysts often provide research and recommendations on stocks, including those with high growth potential. Look for companies that have a large number of buy or strong buy recommendations from analysts.

- Screening for growth metrics: Many stock screening tools allow you to filter for specific growth metrics, such as high revenue or earnings growth.

- Pay attention to the news and trends: High-growth companies are often in industries that are experiencing rapid change or disruption. For example, technology companies in the field of artificial intelligence, cloud computing, and renewable energy are some of the companies that has high growth potential.

It’s important to keep in mind that high-growth stocks can also be high-risk stocks. These companies often have a lot of growth potential, but they also have a lot to prove.

Additionally, these companies are more likely to be affected by economic downturns and market volatility.

It’s also important to keep in mind that past performance is not indicative of future results, and investing in the stock market always carries a level of risk. Additionally, it’s important to diversify your portfolio, and not to put all your eggs in one basket.

Utilizing market trends and technical analysis for short-term gains

Utilizing market trends and technical analysis can be a strategy for earning short-term gains from the stock market. Technical analysis is a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volume.

Some ways to utilize market trends and technical analysis for short-term gains include:

- Identifying trend lines: This involves analyzing historical price data to identify patterns and trends in the market. These patterns can indicate when a stock is likely to continue moving in a certain direction, and can be used to make buy or sell decisions.

- Using technical indicators: Technical indicators are mathematical calculations based on the price and/or volume of a security. These indicators can provide information on things like momentum and volatility, and can be used to make buy or sell decisions.

- Reading charts: Charts are visual representations of historical price data, and can be used to identify patterns and trends. Different chart types, such as line charts, bar charts and candlestick charts, can provide different information on stock prices and trends.

- Utilizing market sentiment: Market sentiment refers to the overall attitude or feeling of the market, and can be analyzed through tools such as social media or news sentiment analysis.

It’s important to note that technical analysis is not a perfect science, and past performance is not indicative of future results.

Additionally, it’s important to keep in mind that the stock market is affected by many factors, including economic conditions and company-specific news, and technical analysis should be used in conjunction with fundamental analysis.

It’s also important to keep in mind that short-term trading carries additional risks, such as the risk of missing out on long-term gains and the risk of making emotional decisions based on short-term market movements.

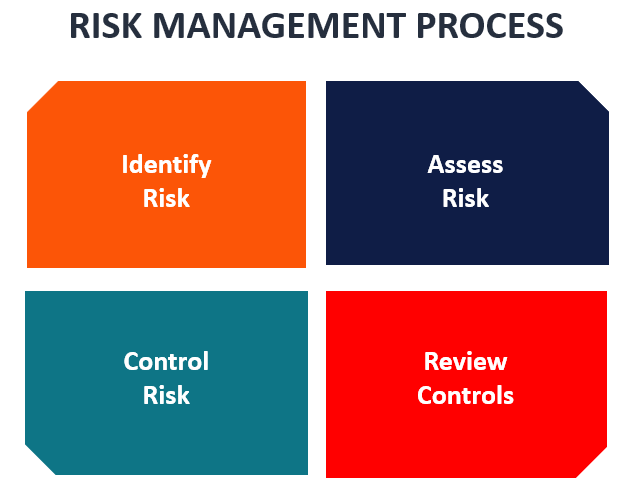

Risk management techniques for earning consistent daily income

Risk management is an important aspect of earning consistent daily income from the stock market.

It involves identifying, assessing, and mitigating the risks associated with your investments. This can help you earn consistent returns while minimizing the potential for losses.

Some risk management techniques for earning consistent daily income include:

- Diversification: Diversifying your portfolio by investing in a variety of stocks and other securities can help spread the risk across different assets. This can help reduce the impact of any one investment on your overall portfolio.

- Setting stop-losses: A stop-loss is a predetermined level at which you will sell a security if it falls in value. This can help limit your losses in case of a market downturn.

- Setting profit targets: Profit targets are predetermined levels at which you will sell a security if it rises in value. This can help lock in gains and reduce the risk of losing profits.

- Implementing position sizing: Position sizing is the practice of adjusting the number of shares or contracts you hold based on the size of your account and the level of risk you are willing to take. This can help ensure that any one trade does not have a disproportionate impact on your overall portfolio.

- Regularly monitoring your portfolio: Regularly monitoring your portfolio can help you identify potential risks and make adjustments as needed.

It’s important to keep in mind that risk management is an ongoing process, and it’s not possible to completely eliminate risk when investing in the stock market.

It’s important to keep in mind that risk management is an ongoing process, and it’s not possible to completely eliminate risk when investing in the stock market.

Additionally, it’s important to have a solid understanding of the different types of risk involved in stock market investing, such as systematic risk, unsystematic risk, and market risk.

It’s also important to remember that risk management should be paired with a well-defined investment strategy, and that consistent daily income is not always possible, as the stock market is affected by numerous factors, some of which are beyond your control.