Analysis of Gustave Eiffel’s Legacy for Investors Potential Impacts on Engineering, Construction, Materials, and Innovation Stocks

Analysis for a Layman

The article discusses the life and career of French engineer Gustave Eiffel, who designed and built over 500 structures globally, but is best known for the Eiffel Tower in Paris. Some key points:

- Eiffel had German roots but dropped the German part of his name (“Bonickhausen dit Eiffel”) after the 1870 Franco-Prussian war, fearing it could hurt his career in France.

- His most famous creation is the Eiffel Tower, built for the 1889 World Fair in Paris. The tower was the tallest human-made structure for 40 years.

- Other major projects included train stations, bridges, lighthouses, the framework for the Statue of Liberty, and infrastructure projects like locks for the Panama Canal.

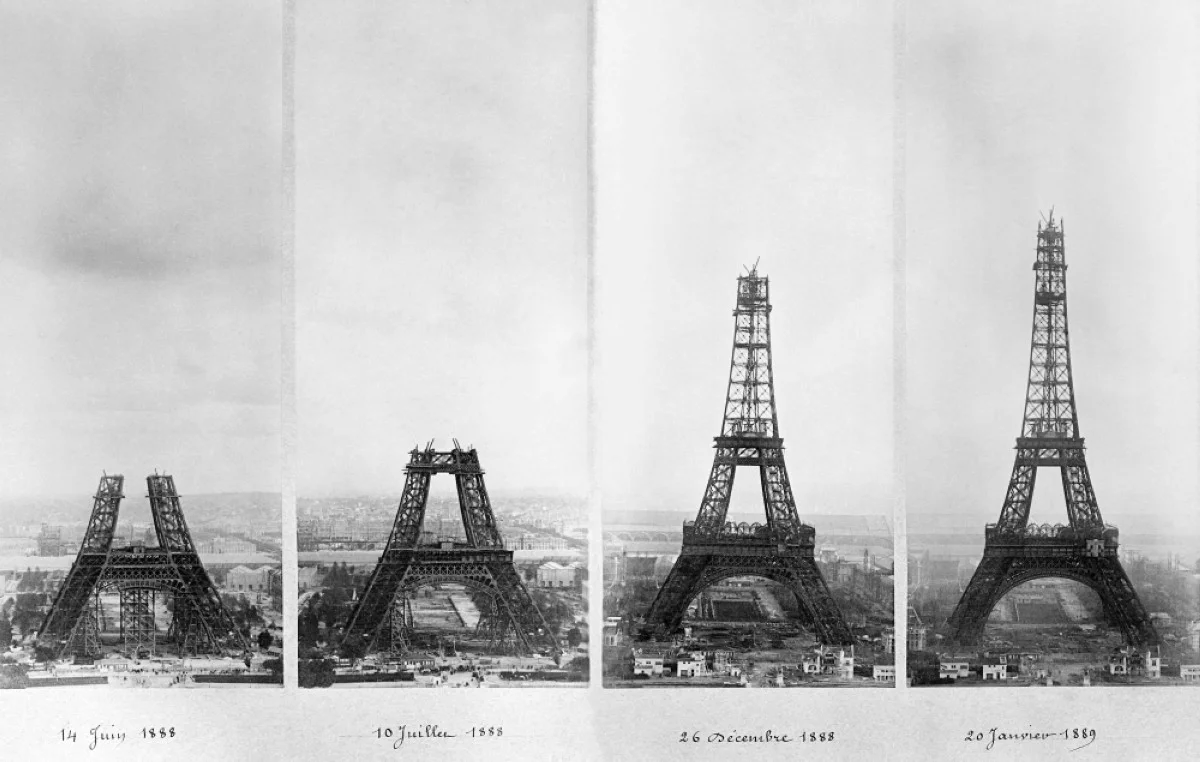

- He was innovative in using iron and metal framework designs that were efficient and allowed taller structures. His company pre-fabricated components in factories, then assembled them on-site, enabling rapid construction.

- He was as much an entrepreneur as an engineer, taking on major infrastructure contracts around the world. But a failed Panama Canal project damaged his reputation before retirement.

Impact on Retail Investors

For retail investors, Eiffel’s story exemplifies how engineering innovations and infrastructure development can drive economic growth. Stocks related to materials, construction, transportation, and infrastructure could benefit.

For example, steel companies like Tata Steel, JSW Steel and SAIL may see increased demand if Eiffel-style metal infrastructure projects are undertaken in India. Construction majors like Larsen & Toubro, seeing renewed interest in advanced building techniques, may also benefit.

Stocks related to smart city development, transportation networks, renewable energy projects and defence manufacturing which involve significant infrastructure building may also be positively impacted if Eiffel’s techniques are more widely replicated. Examples include Bharat Heavy Electricals Limited, Titagarh Wagons, BEML Limited.

However, investors must carefully evaluate the feasibility and funding availability of such complex infrastructure projects in India’s current economic climate before investing based solely on potential upsides. Regulatory issues, environmental clearances required, and political will for such programmes must be assessed.

Impact on Industries

Eiffel’s innovative construction methods centred around prefabricated iron frameworks could directly benefit India’s infrastructure and engineering sectors today.

Firms in fields like civil engineering, architectural design, construction materials manufacturing, and public infrastructure development may see renewed demand if techniques used by Eiffel become more mainstream. This includes industries like metalworks, glass and façade contractors, steel manufacturers, fabrication workshops, and construction equipment producers.

For example, glass façade contractors like Saint-Gobain, Asahi India Glass Ltd. or metal alloys manufacturers like Jindal Stainless Ltd, Mishra Dhatu Nigam Limited could gain. Front-end civil engineering and construction players like KNR Constructions, Ahluwalia Contracts, NCC Ltd. may also benefit.

Additionally, this construction technique requires significant project management and urban planning expertise. So demand for engineering consultancies and infrastructure advisory firms could rise. Companies like Engineers India Ltd., VA Tech Wabag Ltd, Ramboll India Private Ltd may see upside.

Long Term Benefits & Negatives

Longer term, mainstreaming efficient, eco-friendly infrastructure approaches championed by Eiffel could significantly benefit India. Project prefabrication in controlled environments reduces waste generation compared to traditional on-site builds. Modular components also increase speed of project execution versus legacy builds.

Urban congestion can be reduced with taller, optimized metal frameworks holding elevators, machine rooms and utilities as demonstrated in Eiffel Tower. This allows getting more usage and value out of expensive inner-city land parcels.

However, regulatory complexities around environmental approvals, change management with legacy contractors used to old techniques, and high upfront cost of modern equipment could negatively impact mainstream adoption in India. Re-skilling workforce to handle advanced materials and fabrication may also limit speed of transformation.

Short Term Benefits & Negatives

In the near term, major beneficiaries of this construction technique could be India’s upcoming metro rail and rapid transport projects, defense installations upgrades and smart cities development.

Eiffel’s prefabrication method allows faster track laying and station construction which is crucial for metro rails and high speed trains to avoid project delays. Companies like Larsen & Toubro, Afcons Infrastructure, KEI Industries engaged in such projects could benefit directly.

Defence sector could benefit as prefabricated modules easier to transport allows rapid forward base deployments. With border infrastructure upgrades underway, defence contractors like Mishra Dhatu Nigam Limited, Bharat Heavy Electricals Limited could see upside.

However, drastically changing conventional build approaches requires intensive planning and flawless coordination between project owners, architects, fabricators, and erectors. Lack of experience with rapid construction techniques could mean short term pain on current smart cities projects before positive impacts start accruing.

So in the near term, select companies participating in transport, defence or urban contracts may benefit far more than those lacking credible project pipelines in these domains.

Market Analysis Based on Gustave Eiffel’s Commemoration

While the provided information primarily features historical facts about Gustave Eiffel, it inadvertently presents potential implications for specific industries and companies. Here’s a breakdown of potential gains and losses for Indian and Global companies:

Indian Companies:

Gainers:

- Tourism-related companies: Increased global interest in Eiffel and his work could boost tourism to Paris, potentially benefiting Indian travel agencies, airlines, and hospitality companies.

- Infrastructure companies: Eiffel’s legacy in constructing iconic structures might inspire ambitious infrastructure projects in India, potentially favoring large construction companies like Larsen & Toubro and infrastructure development firms like IRB Infrastructure Developers.

- Media and entertainment companies: Renewed public fascination with Eiffel could lead to documentaries, films, or even video games based on his life, benefiting production houses and media platforms like Zee Entertainment Enterprises or Reliance Entertainment.

Losers:

- Heritage conservation groups: The article highlights Eiffel’s demolition of historical structures for his projects, potentially raising concerns about similar practices in India. This could negatively impact NGOs and groups advocating for heritage preservation.

- Companies reliant on traditional construction methods: Eiffel’s pioneering use of advanced materials and innovative techniques might push for modernization in India’s construction sector, potentially disadvantaging companies heavily reliant on older methods.

Global Companies:

Gainers:

- Engineering and construction giants: Renewed interest in Eiffel’s engineering feats could benefit companies like Bechtel or AECOM, potentially leading to increased demand for their expertise in building complex structures.

- Metal and steel producers: Increased focus on Eiffel’s iconic iron structures might raise demand for metal and steel, potentially benefiting major producers like ArcelorMittal or Nippon Steel.

- Tourism & travel operators: Similar to Indian companies, global tourism giants like Expedia or Booking Holdings could experience increased bookings to France due to Eiffel’s renewed popularity.

Losers:

- Construction companies with poor safety records: Eiffel’s projects, while groundbreaking, faced criticism for worker safety. Companies with similar records could face negative publicity and potential regulatory scrutiny.

- Environmental groups: Some of Eiffel’s projects, like the Panama Canal, faced environmental concerns. This could lead to increased scrutiny of large infrastructure projects globally, potentially disadvantaging companies with poor environmental records.

Market Sentiment:

The news is unlikely to have a significant direct impact on stock prices, as it primarily focuses on historical events. However, the indirect effects mentioned above could influence market sentiment over time. Companies associated with tourism, infrastructure, and advanced engineering might see a slight positive sentiment boost, while those with negative connotations regarding heritage preservation, safety, or environmental impact could face potential pressure.

Remember, this is just a speculative analysis based on limited information. The actual impact of Eiffel’s commemoration on these companies will depend on various other factors and market dynamics.

Citation: AFP, “Gustave Eiffel: French icon who sparked a skyscraper frenzy”, Dec 26, 2023